ЗАБЫТЫЕ КЛИЕНТЫ

Менеджеры забывают связаться с клиентом, если клиент сам долгое время ничего не заказывает

ЗАБЫТЫЕ КЛИЕНТЫ

Менеджеры забывают связаться с клиентом, если клиент сам долгое время ничего не заказывает

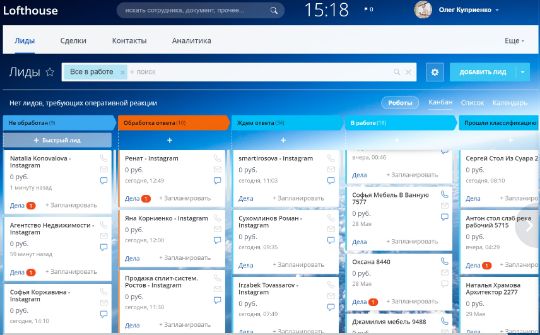

ПОТЕРЯ ЗАЯВОК

Вы вкладываете деньги в рекламу (Яндекс, Google), а заявки, звонки теряются или обрабатываются поздно и клиенты уходят

УТЕЧКА БАЗЫ

Актуальная база по работе с клиентами есть только у менеджера и в случае ухода сотрудника собственник теряет своих клиентов

БЕЗ КОНТРОЛЯ

Все чем-то заняты и что-то делают, а чем именно заняты, сколько звонов совершили, сколько отправили КП и тп. оценить объективно невозможно

официальный партнер

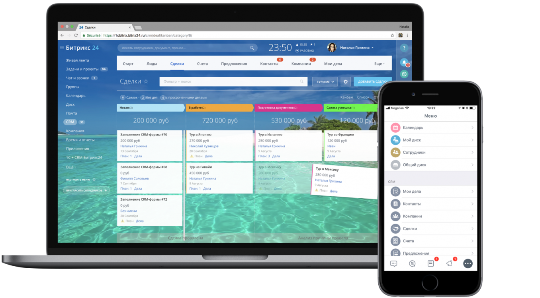

Битрикс24

Консалтинговая группа BRAINTOP основана в 2011 году и на данный момент является официальным партнером Битрикс24 в Ростове-на-Дону и активно развивается на рынке внедрения CRM России

ПОМОЖЕМ РЕШИТЬ СЛЕДУЮЩИЕ ЗАДАЧИ:

2. ПРОВЕСТИ ОБУЧЕНИЕ

5. ПЕРЕНЕСТИ КЛИЕНТСКУЮ БАЗУ

6. ПОДКЛЮЧИТЬ ЗАЯВКИ

Не знаете на сколько ВАМ подойдет Битрикс24?

Тарифы внедрения